Scenario 12: Being asked to get an ABN

‹Previous Scenario English | 中文 | Tiếng Việt | Español Next Scenario›

Learn more about issues like this

Learn more about the people and places that can help

Free Legal Help

Lawyers are here to help you. They can give you clear directions about what to do next based on what you want, and they can do things for you like talk to other people, speak in court and draft documents. If you speak to a lawyer, they cannot tell anyone what you have said – including migration authorities, police and family. What you tell them won’t affect your visa, work or education.

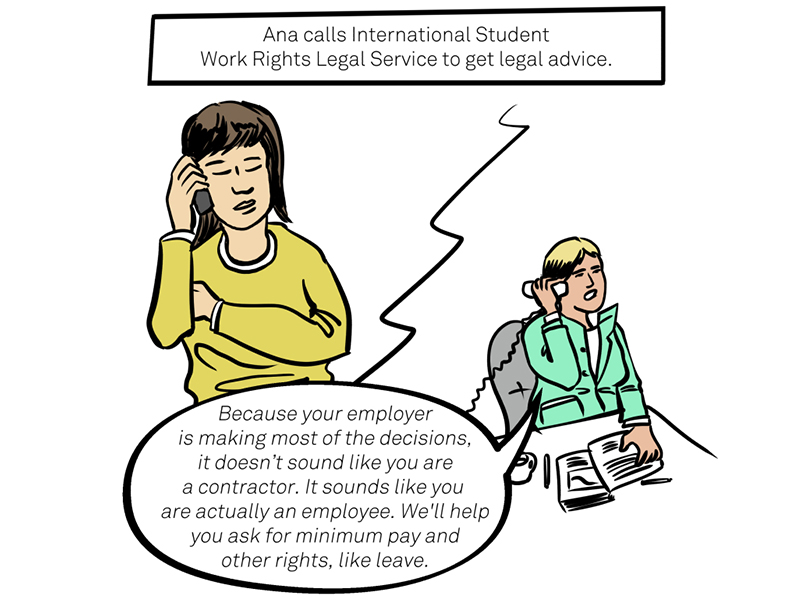

International Students Work Rights Legal Service (ISWRLS)

If you are having issues at work (excluding migration problems), the ISWRLS can provide you with free, confidential and independent legal advice about what to do.